At Madison Resources, we’re dedicated to supporting staffing firms by providing timely legislative insights, practical guidance, and resources that help you stay informed and compliant.

What does this mean for you?

On July 31, 2024, the Michigan Supreme Court ruled in Mothering Justice v. Attorney General that the Michigan state legislature’s 2018 adoption and amendment to the Michigan Earned Sick Time Act (MI ESTA) was unconstitutional. As a result, nearly all Michigan employers will be required to provide employees with more generous paid sick leave than what is currently required under Michigan’s current paid sick leave law

called The Paid Medical Leave Act, beginning on February 21, 2025.

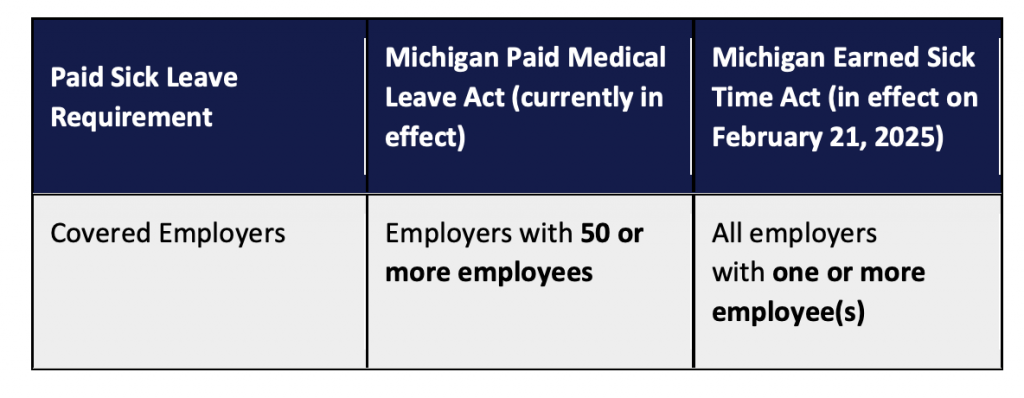

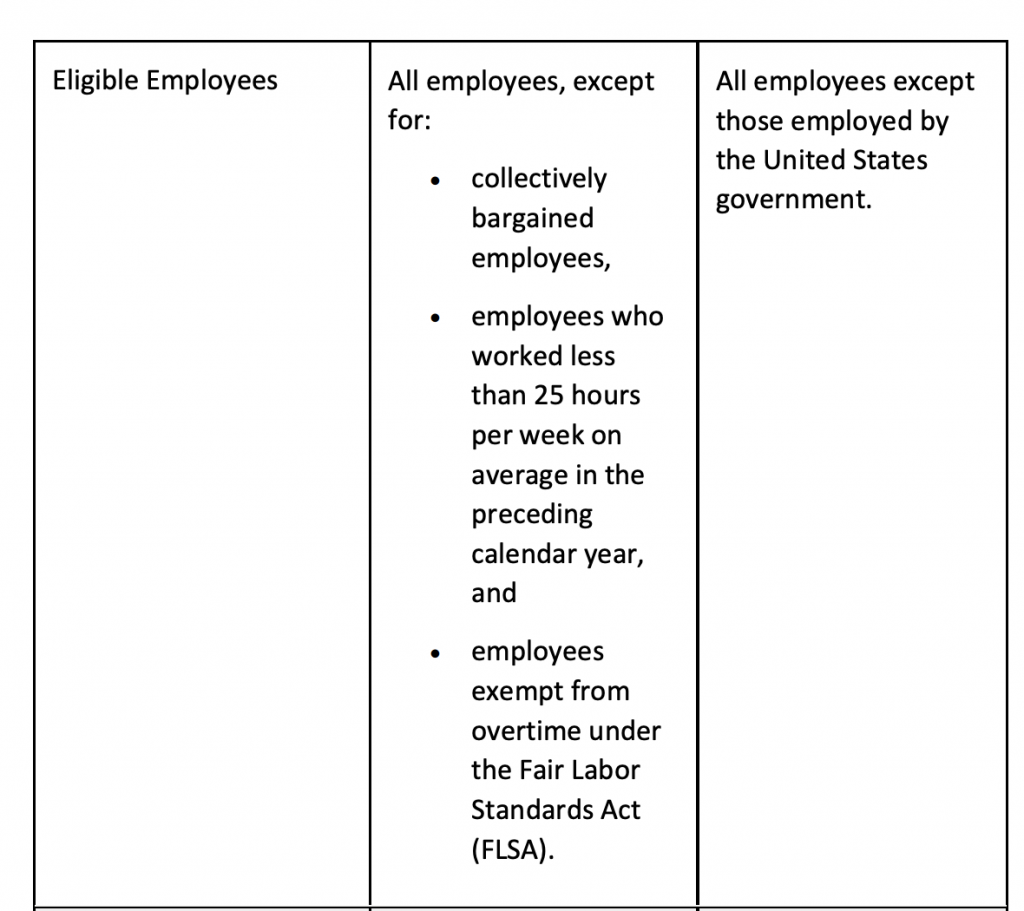

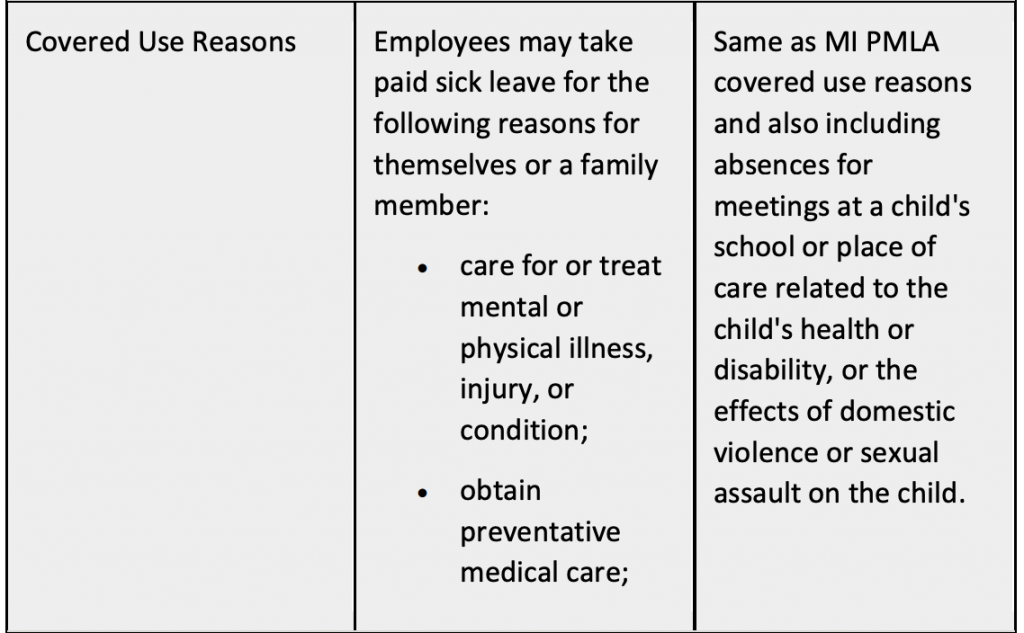

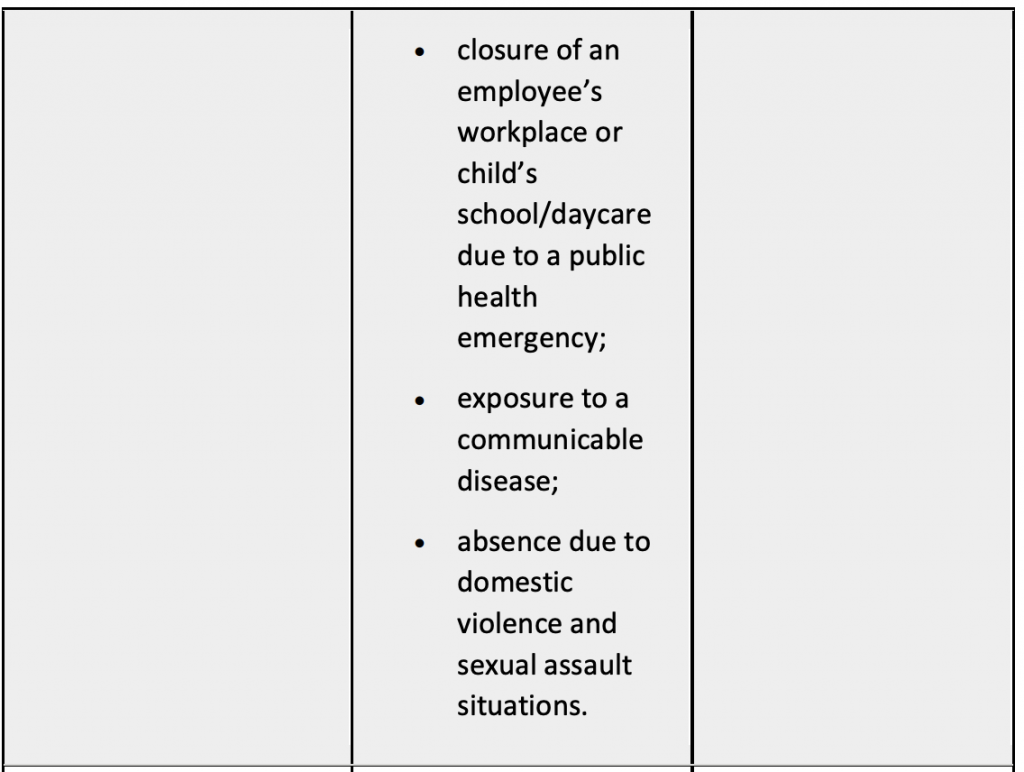

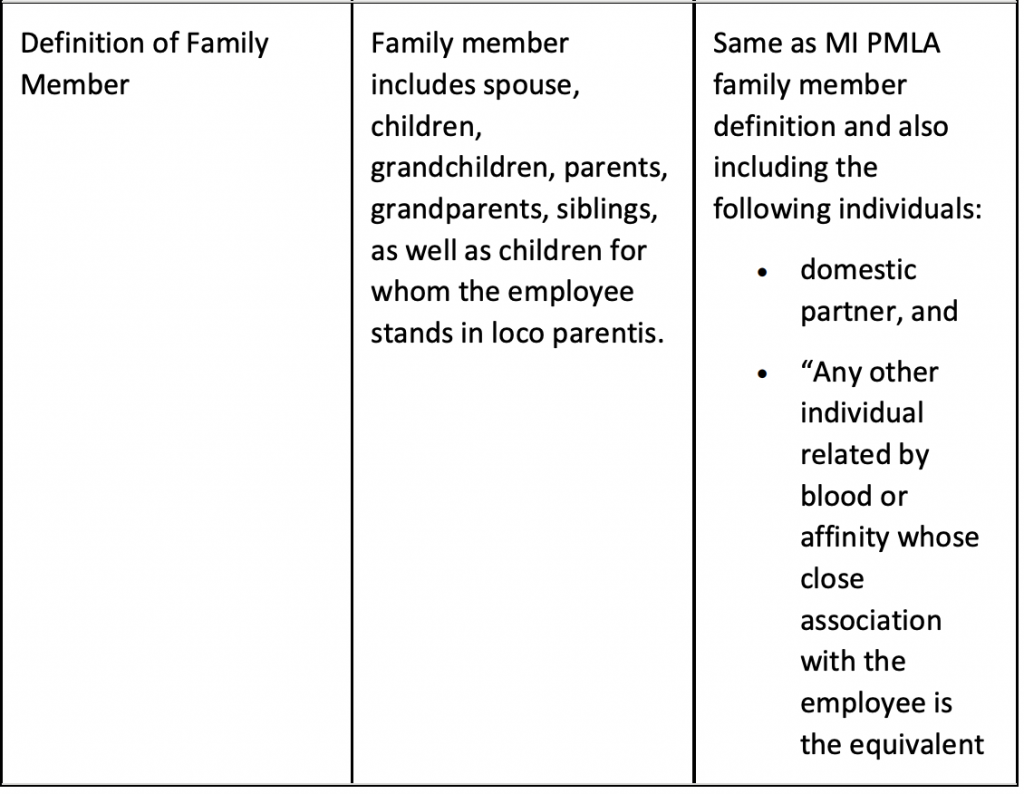

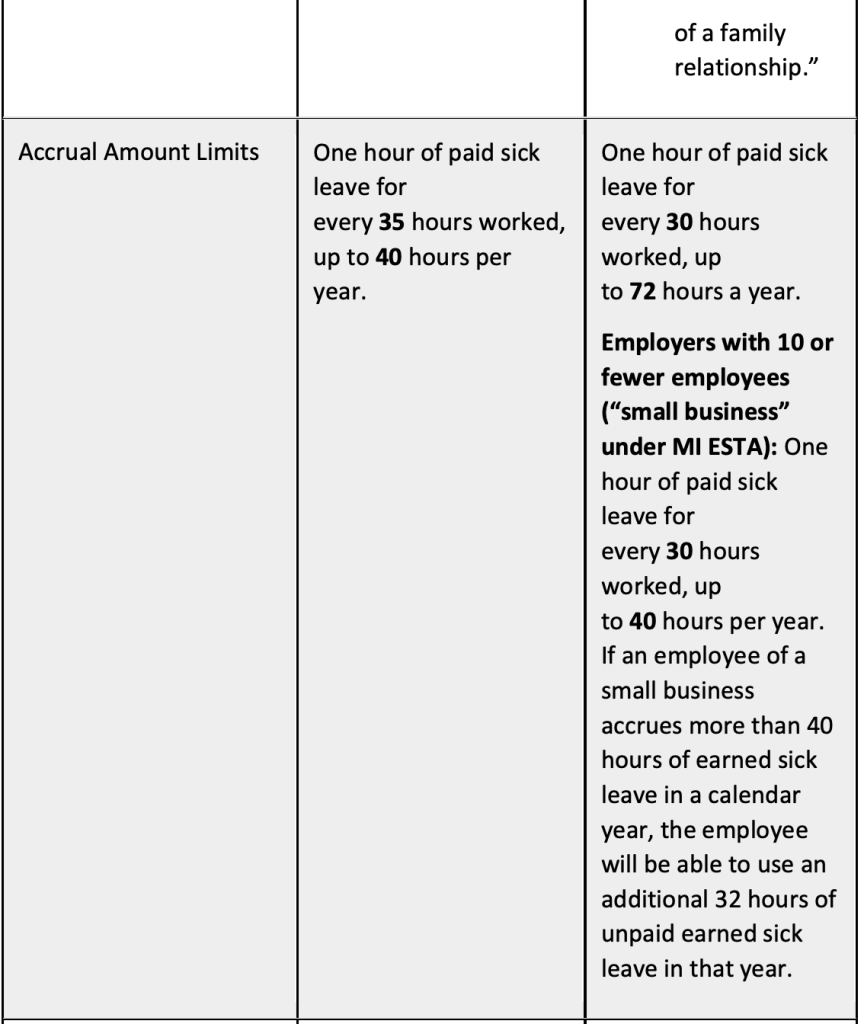

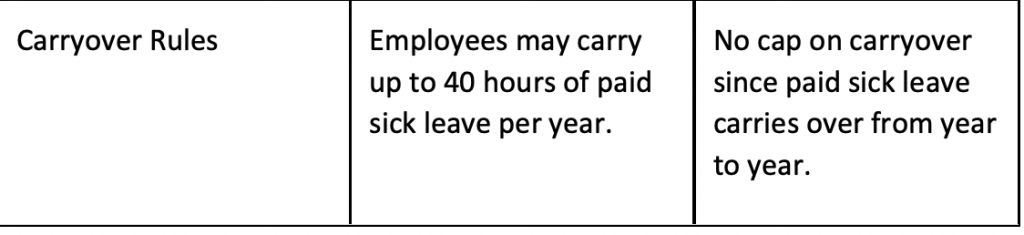

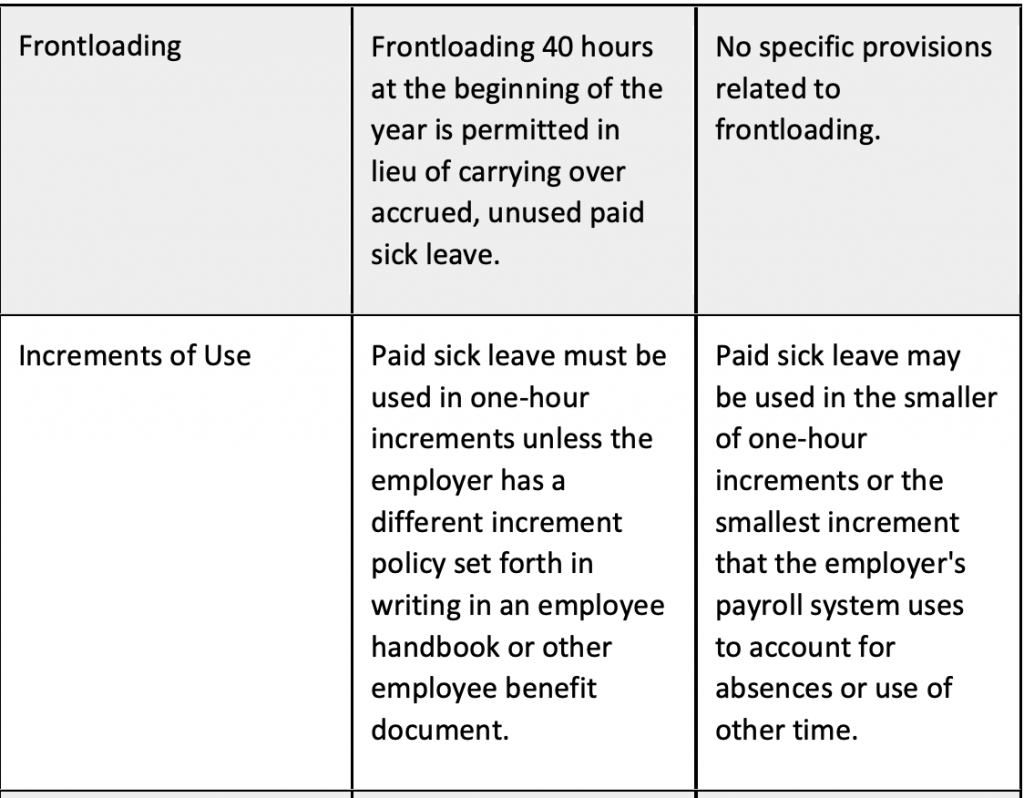

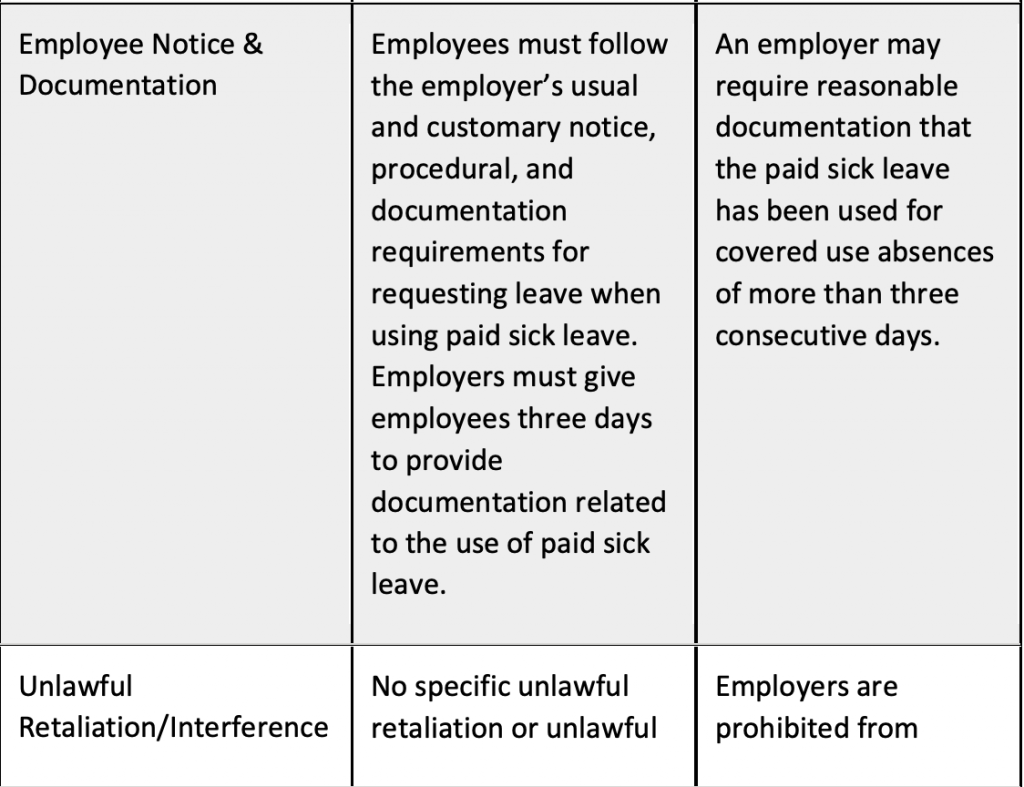

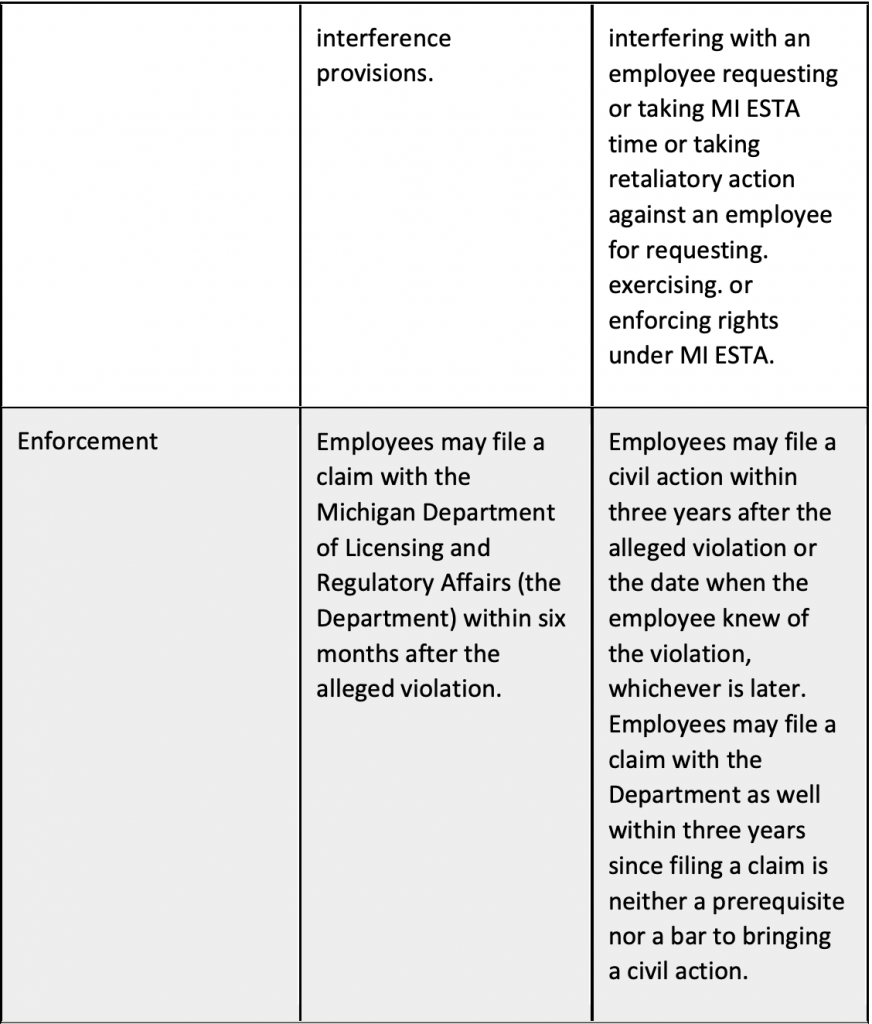

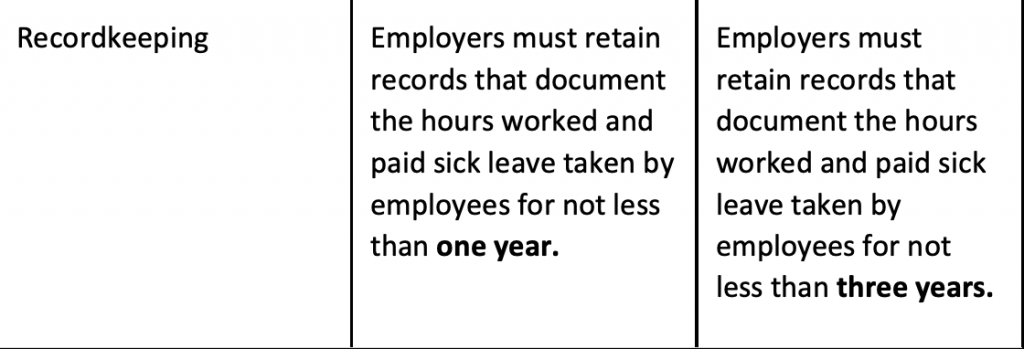

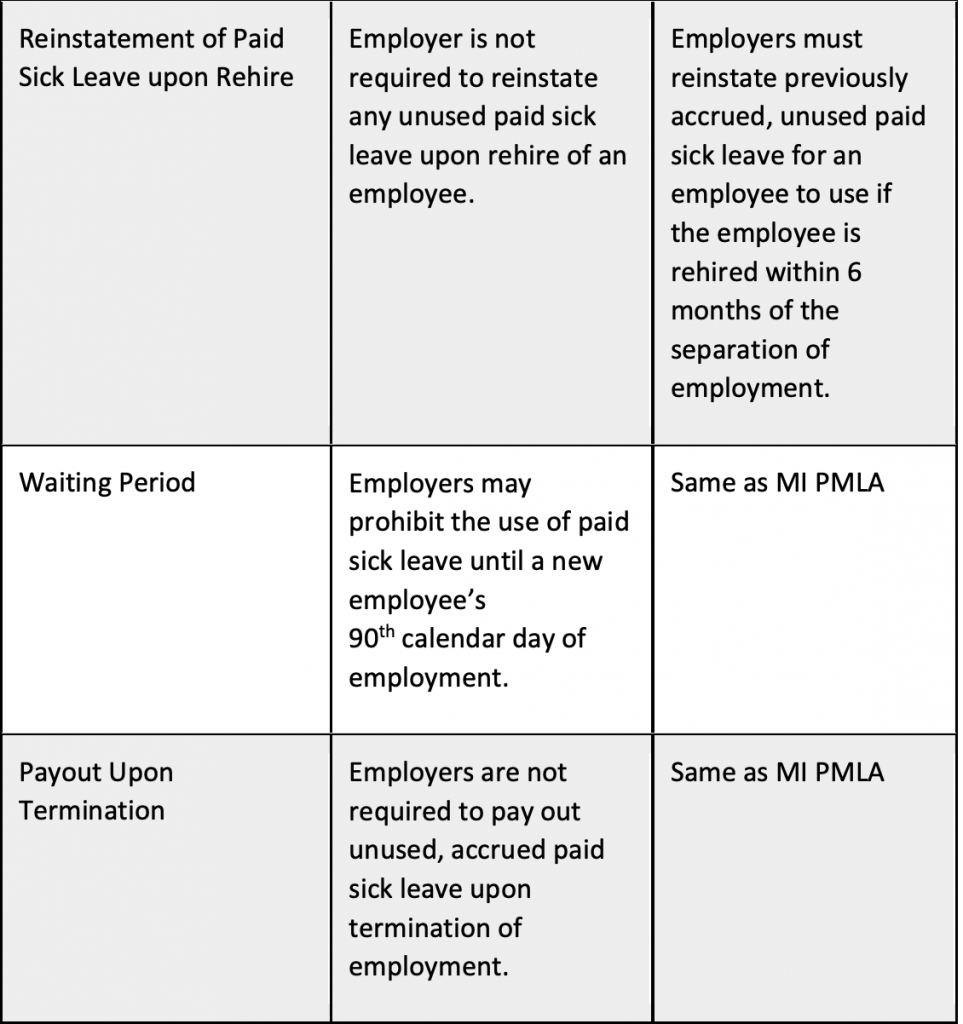

The table below highlights the paid sick leave changes that employers will be required to implement for their employees working in Michigan. Please note that the MIESTA requirements in certain instances are significantly more generous to employees than the current MI PMLA requirements.

As the February 21, 2025 effective date approaches for MI ESTA requirements, employers with Michigan-based employees are advised to begin working with their employment and labor counsel now on the following items to ensure compliance:

- Review and update, as necessary, leave policies and procedures, taking into account previously excluded employees who will now be eligible for MI ESTA paid sick leave

- Previously exempted employers (those employing 50 or fewer employees) will be required to provide paid sick leave and develop applicable MI ESTA policies and procedures

- Review and update, as necessary, attendance and payroll systems especially accounting for the higher accrual amount limits

- o MI ESTA now requires between 40 and 72 hours, depending on employer size (see table above)

- Train Human Resources team members and other employees who manage employee leave

- Communicate these MI ESTA changes to employees

- Monitor the Michigan state webpage for the updated MI ESTA model postings and notices (when available), as well as additional MI ESTA guidance:

How Can We Help?

For purposes of tracking and paying out this paid leave, please use the SICK pay code. Madison Resources’ systems will accrue this earned leave as directed in the legislation for employees working in the state of Michigan. Additionally, you may view available paid sick leave for your employees in our online reporting system, MOS. For questions on the reporting, please reach out to your payroll specialist.

As always, we recommend speaking with your attorney, CPA, or industry professional for further guidance.

Have Questions?

To access the FAQ’s:

https://www.michigan.gov/leo/bureaus-agencies/ber/wage-andhour/paid-medical-leave-act/frequently-asked questions–faqs

Contact Information:

Michigan Department of Labor & Economic Opportunity

Call: (855) 464-9243 or Visit: https://www.michigan.gov/leo/bureaus-agencies/ber/Wage-and-Hour

Stay Informed. Stay Compliant. Grow With Confidence.

Explore our website to find more Legislative Updates. Madison Resources is the premier payroll funding and back office support partner to the staffing industry. Grow with confidence.