How Staffing Company Financing Drives Growth and Profitability

Sales and profitability are crucial indicators of success in the staffing industry, but many firms face growth challenges due to cash flow constraints. Staffing company financing offers a solution by providing the funds necessary to scale operations, hire more talent and expand client acquisition without financial roadblocks.

The Impact of Financing On Growth

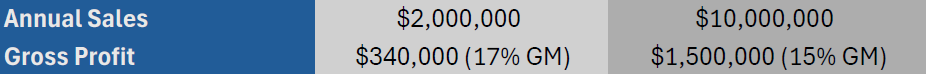

Imagine a staffing company generating $2 million in revenue with a 17% profit margin, resulting in $340,000 in profit. With access to unlimited payroll funding, that same company could grow to $10 million in revenue. Even if the profit margin slightly decreases to 15%, the company’s profit would rise to $1.5 million. Over four times the original amount.

Limited vs. Unlimited Financing

The cost of staffing company financing is often covered by the increased revenue and profit it generates, making it a sustainable growth strategy.

Financing Type: Limited (Self or Bank) vs. Unlimited (Staffing Specific Lender)

The cost of financing is covered by increased revenue and profit making it a self sustaining growth strategy.

Managing Cash Flow and Reducing Risk

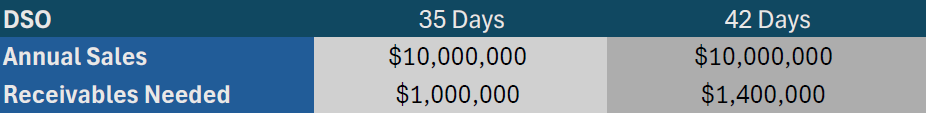

Cash flow can be severely impacted by delayed invoice payments. For example, a staffing company billing $10 million annually with a 35 day DSO (Days Sales Outstanding) has $1 million tied up in accounts receivable. If DSO extends to 42 days, outstanding receivables rise to $1.4 million, creating a $400,000 cash gap. Without sufficient reserves or financing, this cash gap can strain operations and limit growth.

Financing Type: Limited (Self or Bank) vs. Unlimited (Staffing Specific Lender)

Madison Resources, a staffing specific lender, is the solution for both scenarios.

Invest in What You Do Best

While financing is critical, many staffing companies also benefit from outsourcing back office functions to reduce costs and improve efficiency even if they don’t require additional financing.

Case Study: Monday Temporaries

In the mid-2000s, John Monday, owner of Monday Temporaries, was preparing to sell his staffing business. Though he didn’t need financing, he faced a major investment in infrastructure to maintain operations.

Instead of heavy spending on software, hardware, firewalls, and personnel, he outsourced these back-office functions to a staffing-specific company like Madison Resources.

The Results:

- Cost Savings: Eliminated large infrastructure investments.

- Simplified Sale: The purchasing company valued the secure data, streamlined operations, reduce redundancies, and minimized layoffs and severance costs.

By leveraging smart financial strategies, Monday Temporaries saved money and made their sale process smoother and more attractive to buyers.

Unlock your staffing company’s full potential with the right staffing company financing strategy.

Ready to start your funding journey? Partner with Madison Resources today [apply here]

About the Author

Nick Andriacchi is the Chief Revenue Officer at Madison Resources, bringing over 30 years of experience in the funding and payroll industry. Before joining Madison, Nick held leadership roles at two other funding companies, where he built a reputation as a trusted advisor and strategic thinker. Widely regarded as a true industry expert, Nick is passionate about helping staffing firms grow through smart funding solutions and operational support.

Explore our website to find more staffing insights. Madison Resources is the premier payroll funding and back office support partner to the staffing industry. Grow with confidence.