July Jobs Slump: Hiring Stalls as Labor Market Cools

July 2025 Employment Situation Report (BLS)

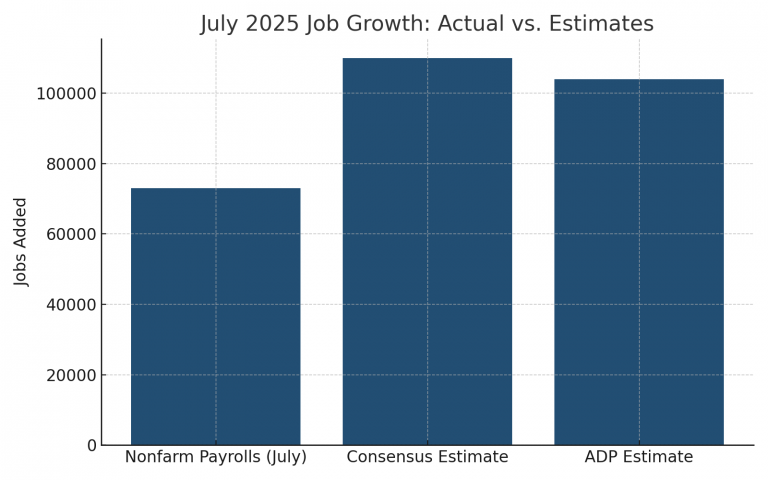

The U.S. labor market continued to show signs of slowing in July, as nonfarm payrolls rose by a seasonally adjusted 73,000—well below the consensus estimate of 110,000. Compounding the weak headline number, May and June job gains were revised downward, removing a combined 258,000 jobs.

Notable details from the July report include:

Healthcare (+55,000) and Retail Trade (+15,700) led sector job gains.

The Federal Government shed 10,000 jobs.

Full-time vs. part-time employment showed little movement.

The U-6 unemployment rate, which includes underemployed and discouraged workers, rose to 7.9%, up from 7.7% in June—pointing to a growing number of Americans settling for part-time or gig work.

Average hourly earnings rose 0.3% month-over-month and are up 3.9% year-over-year. Production and nonsupervisory employees saw average wages rise to $31.34.

The average workweek edged up slightly to 34.3 hours, with marginal increases for production and nonsupervisory employees.

Meanwhile, long-term unemployment (jobless 27 weeks or more) rose by 179,000, bringing the total to 1.8 million, accounting for roughly one-quarter of all unemployed workers.

To sustain population growth, the economy needs to add between 180,000 to 200,000 jobs per month—highlighting how July’s figure falls short of keeping pace.

June 2025 JOLTS Report: Labor Demand Weakening

Data from the June Job Openings and Labor Turnover Survey (JOLTS) reinforces the softening labor demand:

Job openings fell to 7.437 million, down from 7.7 million in May.

Hires slipped to 5.204 million.

Total separations held steady at 5.1 million, while quits remained at 3.1 million, suggesting workers are less confident about finding new opportunities.

Breakdown by industry:

Job openings decreased in:

Accommodation and food services (-308,000)

Health care and social assistance (-244,000)

Finance and insurance (-142,000)

Increases were seen in:

Retail trade (+190,000)

Information (+67,000)

- State and local government education (+61,000)

Layoffs and discharges were largely unchanged at 1.6 million. Interestingly, demand for temporary help may be inching back, though specific July data remains limited.

Key Labor Force Metrics

Here’s a snapshot of other notable labor market indicators from July:

U-6 unemployment (includes discouraged workers and part-timers for economic reasons): 7.9% (+0.2%)

Prime-age labor force participation (ages 25–54): 83.4% (-0.1%)

Overall labor force participation rate: 62.2% (-0.1%)

Still 1.2% below pre-pandemic levels (Feb 2020)Average hourly earnings:

All private nonfarm employees: $36.44 (+$0.12 / +0.3%)

Production & nonsupervisory: $31.34 (+$0.08 / +0.3%)

Workweek:

Private nonfarm: 34.3 hours (+0.1)

Manufacturing: 40.1 hours (unchanged), overtime edged down to 2.8 hours

Also Reported: ADP Private Payrolls

According to ADP, the private sector added 104,000 jobs in July—another sign that hiring is slowing, though still outpacing the BLS report.

Looking Ahead

The next JOLTS report (July data) will be released on Wednesday, September 3, 2025, at 10:00 a.m. ET. As the labor market continues to cool, policymakers and analysts will be watching closely for signs of stabilization—or further weakening.

Sources

BLS – Employment Situation

BLS – JOLTS Report

[CNBC, Fox News, ADP]

Ready to start your funding journey? Partner with Madison Resources today [apply here]

Explore our website to find more staffing insights. Madison Resources is the premier payroll funding and back office support partner to the staffing industry. Grow with confidence.